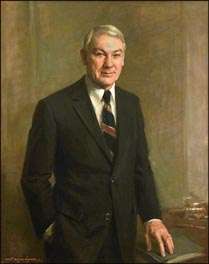

G. William Miller

| William Miller | |

|---|---|

| |

| United States Secretary of the Treasury | |

|

In office August 6, 1979 – January 20, 1981 | |

| President | Jimmy Carter |

| Preceded by | Michael Blumenthal |

| Succeeded by | Don Regan |

| Chair of the Federal Reserve | |

|

In office March 8, 1978 – August 6, 1979 | |

| President | Jimmy Carter |

| Deputy |

Stephen Gardner Frederick Schultz |

| Preceded by | Arthur Burns |

| Succeeded by | Paul Volcker |

| Personal details | |

| Born |

George William Miller March 9, 1925 Sapulpa, Oklahoma, U.S. |

| Died |

March 17, 2006 (aged 81) Washington, D.C., U.S. |

| Political party | Democratic |

| Spouse(s) | Ariadna Rogojarsky |

| Alma mater |

Amarillo College U.S. Coast Guard Academy UC Berkeley School of Law |

| Military service | |

| Allegiance |

|

| Service/branch |

|

| Years of service | 1945–1949 |

George William Miller (March 9, 1925 – March 17, 2006) served as the 65th United States Secretary of the Treasury under President Carter from August 6, 1979 to January 20, 1981. He previously served as the 11th Chairman of the Federal Reserve, where he began service on March 8, 1978.

Miller was the most recent Federal Reserve Chairman to come from a corporate background, rather than from economics or finance. He is also the only person to have served both as Federal Reserve Chairman and as Treasury Secretary.

Early life and career

William Miller was born in Sapulpa, Oklahoma. His family soon moved to Borger, the largest city in Hutchinson County, Texas, where Miller spent his childhood. The town was undergoing an oil boom up until the Great Depression, during which it underwent extensive development under the Work Projects Administration. [1] [2] Miller's father, previously a cab driver, became the town's fire chief.[3] After attending Amarillo College for the 1941-1942 school year, he received an appointment to the U.S. Coast Guard Academy.[2] [4] [5] [6] He graduated in 1945 with a B.S. in marine engineering. From 1945 to 1949, Miller served as a Coast Guard officer in Asia and on the U.S. West Coast. During his time with the Coast Guard, he met Ariadna Rogojarsky, a Russian emigre; they married in 1946.

He graduated top of his class at the Boalt Hall School of Law at the University of California, Berkeley in 1952,[2] and joined the law firm of Cravath, Swaine & Moore in New York City.[7]

In 1956, Miller joined the rapidly growing conglomerate Textron, Inc as an assistant secretary.[5] He became a Vice President of the company in 1957. He was CFO and then company president within a few years.[2] [5] [8] In 1968 he became Chief Executive Officer of Textron and was elected Chairman and Chief Executive Officer in 1974, a post he held until he came to the Federal Reserve Board. [5] Despite the economy's weakening state during his time as CEO, Textron's sales grew 65% to $2.8bn as the company operated 180 plants worldwide. This allowed the company's sales and net income to keep pace with the decade's accelerating inflation (albeit with a temporary dip in inflation-adjusted net income during the 1973-75 recession). [9] [10] [11]

Miller also forayed into politics. From 1963 to 1965, Miller was Chairman of the Industry Advisory Council of the President's Committee on Equal Employment Opportunity; in 1966 and 1967, he was a member of the National Council on the Humanities. Miller also served in the "think tank" Club of Rome. In 1968, he aided Hubert Humphrey's presidential campaign as chairman of a Democratic-leaning business group.[2] He also played a minor role in Jimmy Carter's 1976 presidential campaign. [12] After Carter's election, Miller served on the President's Committee on HIRE. [5] [6] [13]

At the time he joined the Federal Reserve Board, Miller was a director of the Federal Reserve Bank of Boston and of several corporations. He was also a member of the Business Council and the Business Roundtable and Chairman of the Conference Board and of the National Alliance of Businessmen. He also served on two bilateral international economic councils (the US-USSR Trade and Economic Council and the Polish-US Economic Council). [5] [6] [13]

Federal Reserve Chairman

Miller succeeded Arthur Burns as Fed Chairman in March 1978. He inherited a high inflation economy, still suffering from the increase in oil prices from OPEC. The change in the Consumer Price Index was 4.9% in 1976 and 6.7% in 1977.[14] Nevertheless, Miller believed that inflation was not too high, and would be self-correcting.[15] He thus pursued a strongly dovish policy and opposed raising interest rates. The effect of this was to send the dollar's value spiraling downward. In November 1978, only 11 months into his term, the dollar had fallen nearly 34% against the German mark and almost 42% against the Japanese yen, prompting the Carter administration to launch a "dollar rescue package" including emergency sales from the U.S. gold stock, borrowing from the International Monetary Fund, and auctions of Treasury securities denominated in foreign currencies.[16][17] This proved only a short-term fix; although temporarily steadying the dollar, it soon resumed its fall.[18] The portmanteau stagflation, the combination of stagnation and inflation, was used increasingly during this time to describe the high rate of inflation, which failed to spur the economy.

Miller's lackadaisical measures against inflation caused distress among members of the Carter Administration itself. Treasury Secretary Blumenthal, Inflation Adviser Alfred Kahn, and Chief Presidential Economist Charles Schultze all advocated for increasing the interest rate prior to the April 1979 meeting, where Miller opposed such measures. Carter had to admonish his own staff over the press leaks used to carry on the dispute.[19]

Miller was not perceived as having great prestige; not coming from an economics or Wall Street background, he was seen as an "outsider."[20] A 2003 article in The Economist said that "America's central bankers have all made their weight felt across the political sphere, with the possible exception of William Miller, whose brief tenure in 1978-79 was notable for his attempts to ban smoking at the board."[21] It is rare for the influential chair's opinion to not carry the vote at the Federal Reserve's meetings, but Miller was outvoted by the Board of Governors at a meeting in 1979 where he opposed an increase in the discount rate, the rate at which the Federal Reserve lends to banks.[20]

Economic historians have generally considered Miller's short tenure unsuccessful. The high inflation that Miller allowed required harsh "shock therapy" treatment by his successor, Paul Volcker, to bring inflation under control. This sent the U.S. economy into recession from 1980 to 1982. Steven Beckner, a Federal Reserve analyst, offered a particularly harsh assessment:

Under Arthur Burns, who chaired the Fed from 1970 to 1978, and under G. William Miller, who was chairman from January 1978 (Note: obviously an error from Beckner since Miller began in March) to August 1979, the Fed provided the monetary fuel for an inflation that began as a flicker and grew into a fearsome blaze... If Nixon appointee Burns lit the fire, Miller poured gasoline on it during the administration of President Jimmy Carter. Without question the most partisan and least respected chairman in the Fed's history, this former Textron executive worked in tandem with fellow Carter appointee, Treasury Secretary W. Michael Blumenthal, in pursuit of monetary policies that were expansionist domestically and devaluationist internationally. The goals were to spur employment and exports, with little thought to the dollar's value. By early 1980, inflation was running at 14 percent per year.[17]— Steven Beckner, Back from the Brink: The Greenspan Years

Treasury Secretary

Miller was Fed chairman for just over a year when Carter appointed him Secretary of the Treasury in August 1979, replacing Michael Blumenthal as part of a major cabinet shuffle in which five Cabinet members were replaced.[22] Carter appointed Paul Volcker to replace Miller. He thus became the only person to serve as both Treasury Secretary and Chairman of the Federal Reserve. As Treasury Secretary, Miller is best known for his role on the Chrysler Loan Guarantee Board, which oversaw management of a $1.5 billion loan to rescue the carmaker from bankruptcy. This attracted some controversy as the bailout was thought to reward mismanagement and impede fair trade relations between the United States and Japan. Miller agreed that "The administration does not favor, as a general proposition, government aid to private corporations,"[7] but thought an exception should be made in Chrysler's case. Chrysler recovered in the early 1980s and paid off the loan early.

Miller is also known for managing the freezing and partial unfreezing of $12 billion in Iranian funds held in the United States during the Iranian hostage crisis. He also pushed through an accord with labor unions on wage-price guidelines that had been "stalemated for months."[2]

Miller's economic policies failed to contain inflation and had little impact on rising unemployment rates. The poor state of the economy was a major factor in Carter's 1980 defeat by Ronald Reagan.

Later years

After Carter's administration ended, Miller founded G. William Miller & Co., a Washington private investment company that he likened to a discreet, Swiss-style merchant bank.[7] He also served positions on a number of charitable and nonprofit organizations. These included treasurer of the American Red Cross, a trustee and director of the Washington Opera, and chairman of the Washington-based H. John Heinz III Center for Science, Economics and the Environment. He also was chairman and chief executive of Federated Stores Inc. (now Macy's, Inc.) from 1990 to 1992.[2]

William Miller died on March 17, 2006 from idiopathic pulmonary fibrosis, a lung condition, at the age of 81.[7]

References

- Department of the Treasury Resignation of W. Michael Blumenthal and Nomination of G. William Miller To Be Secretary. July 19, 1979 American Reference Library

- ↑ 1930 United States Federal Census

- 1 2 3 4 5 6 7 McFadden, Robert D. (2006-03-19). "Obituary: G. William Miller". The New York Times. Retrieved 2014-04-01.

- ↑ 1930 and 1940 United States Federal Censuses

- ↑ https://www.actx.edu/foundation/index.php?module=article&id=48

- 1 2 3 4 5 6 ""Nomination of G. William Miller [microform] : hearing before the Committee on Banking, Housing, and Urban Affairs, United States Senate, Ninety-fifth Congress, second session ... January 24, 1978."". Hathi Trust Digital Library.

- 1 2 3 ""Biography -- 1979 (bundled) (Banking -- Nominations/Confirmations -- Miller for Treasury -- 1979)"". Carnegie Mellon University Digital Collections, H. John Heinz III Collection. Retrieved 2016-06-18.

- 1 2 3 4 Bernstein, Adam (2006-03-20). "Obituary: Fed Chairman G. William Miller, 81". The Washington Post. Retrieved 2007-11-21.

- ↑ "William Who?: Textron Chief to Head Federal Reserve Board In a Surprise Selection". The Wall Street Journal. 1977-12-29.

- ↑ "Digest of Earnings Reports". The Wall Street Journal. 1969-01-29.

- ↑ "Digest of Corporate Earnings Reports". The Wall Street Journal. 1978-02-16.

- ↑ Farnsworth, Clyde (1977-12-29). "Burns Is Out as Chief of Fed; Carter Names Miller, Textron Head".

- ↑ Meltzer, Allan (2003). A History of the Federal Reserve. Chicago: University of Chicago Press.

- 1 2 ""G. William Miller (1979-1981)"". Retrieved 2014-03-01.

- ↑ Consumer Prince Index, from the Department of Labor

- ↑ "Educate Yourself: Paul Volcker". Retrieved 2007-12-06.

- ↑ "Record of Policy Actions: November 21, 1978" (PDF). Federal Open Market Committee. 1978-11-21. Retrieved 2007-11-29.

- 1 2 Beckner, Steven K. (1996). Back from the Brink: The Greenspan Years. New York, NY: John Wiley & Sons, Inc. p. 5. ISBN 0-471-16127-6.

- ↑ "The Squeeze of '79". Time. 1979-10-22. Retrieved 2007-11-27.

- ↑ "The Fed vs. Jimmy's Aides". Time. 1979-04-30. Retrieved 2007-12-06.

- 1 2 Belden, Susan. Policy preferences of FOMC members as revealed by dissenting votes

- ↑ "After Alan". The Economist. 2005-08-13. Retrieved 2007-11-16.. The order of the sentence is reversed for clarity here.

- ↑ "Carter's Great Purge". Time. 1979-07-30. Retrieved 2007-12-06.

External links

- Secretaries of the Treasury, G. William Miller - Official profile

- Minutes and Policy Actions of the Federal Open Market Committee, Historical

- Statements and Speeches of G. William Miller

| Government offices | ||

|---|---|---|

| Preceded by Arthur Burns |

Chair of the Federal Reserve 1978–1979 |

Succeeded by Paul Volcker |

| Political offices | ||

| Preceded by Michael Blumenthal |

United States Secretary of the Treasury 1979–1981 |

Succeeded by Don Regan |